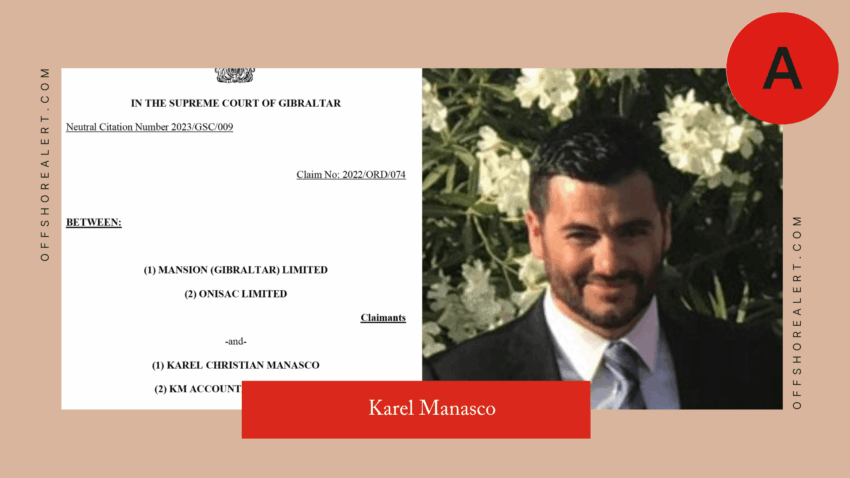

Karel Mañasco, former chief executive of Mansion (Gibraltar) Limited, recently made headlines as he was sentenced to 12 months in prison by the Gibraltar Supreme Court for contempt of court. This ruling stems from his serious breaches of asset-freezing orders, where he illicitly transferred over £400,000 to an account belonging to his wife in Spain while submitting false statements under oath. Chief Justice Anthony Dudley emphasized the severity of Mañasco’s actions, describing the transfer as “egregious” and detrimental not only to the claimants but also to the integrity of the legal system. The court underscored the necessity of a custodial penalty given the substantial violations of fiduciary duties involved. As this legal saga unfolds, the implications for both Mañasco and the Mansion Group are significant, raising crucial questions about accountability and corporate governance in the realm of business law.

In a dramatic turn of events, the legal troubles surrounding Karel Mañasco have drawn considerable attention, especially regarding his professional conduct at Mansion (Gibraltar) Limited. The Supreme Court ruling highlights critical issues of court contempt and asset management, indicative of a larger narrative about ethical corporate practices. Mañasco’s actions, including the questionable transfers and misleading financial disclosures, reveal significant challenges faced by businesses in adhering to fiduciary responsibilities. As the legal proceedings evolve, the repercussions for the Mansion Group serve as a reminder of the importance of compliance with court orders and the rule of law. This case not only sheds light on personal accountability but also underscores the broader implications for corporate governance.

The Consequences of Court Contempt: Karel Mañasco’s Case

Karel Mañasco’s recent sentencing to 12 months in prison highlights the serious repercussions of contempt of court. As the former chief executive of Mansion (Gibraltar) Limited, he was found guilty of multiple breaches of asset-freezing orders and submitted false statements under oath. The Gibraltar Supreme Court, presided over by Chief Justice Anthony Dudley, emphasized the gravity of his violations, notably the unauthorized transfer of over £400,000 to his wife’s account in Spain. This incident is not just a personal failure for Mañasco; it undermines the integrity of the legal system and its ability to enforce justice. By ignoring the court’s directives, Mañasco not only harmed the claimants but also set a perilous precedent regarding compliance with judicial orders.

Additionally, the court’s stern response, which included a potential six-month reduction of the prison term contingent on repayment, confirms that breaches of fiduciary duties have severe legal consequences. Such measures are designed to deter similar misconduct in the future, sending a strong message that integrity in business and adherence to court orders are paramount. The ramifications of Mañasco’s actions will likely extend beyond his personal consequences, impacting the faith in corporate governance and judicial authority.

The significance of Mañasco’s case lies in the broader implications for executives and corporations alike. Contempt of court is a serious offense that not only reflects poorly on the individual involved but also affects the reputation of the organization they represent. As seen in this instance, the Gibraltar Supreme Court’s ruling serves as a cautionary tale for other professionals in fiduciary roles. Maintaining transparency and adhering to legal obligations is essential for upholding one’s reputation and the trust of stakeholders in any business environment.

Mañasco’s unauthorized financial maneuvers, coupled with false declarations, present a critical lesson about accountability. With the Mansion Group alleging that he misappropriated approximately £5 million, this case reinforces the need for maintaining stringent checks and balances within corporate environments. It emphasizes the importance of compliance with fiduciary duties and the repercussions that arise from negligence and malfeasance in leadership positions.

Fiduciary Duties and the Legal Implications of Mismanagement

Fiduciary duties are foundational to the obligations held by executives and directors towards their companies and shareholders. Karel Mañasco’s actions, including the alleged misappropriation of corporate funds for personal gain, illustrate how breaches of these duties can lead to severe legal ramifications, including custodial sentences. The Mansion Group’s accusations showcase an alarming pattern of behavior, where the executive allegedly awarded himself excessive salaries and bonuses while engaging in dubious financial dealings. Such mismanagement not only jeopardizes the company’s financial stability but also erodes stakeholder trust.

In any organization, leaders are expected to act in the best interests of their company and its shareholders, avoiding conflicts of interest and maintaining transparent practices. Mañasco’s case serves as a stark reminder of the potential consequences of neglecting fiduciary responsibilities, demonstrating the critical need for corporate governance structures that enforce ethical behavior and protect the interests of all parties involved.

The legal consequences faced by Mañasco are a window into the rigorous enforcement of fiduciary duties within corporate law. With the Gibraltar Supreme Court ruling against him for contempt of court, the expectation from business leaders becomes clearer: adherence to fiduciary responsibilities isn’t optional. The repercussions of mismanagement, such as asset freezing orders, remind us that the legal system is equipped to intervene when ethical standards are compromised. In Mañasco’s case, the court’s rulings are indicative of a zero-tolerance approach to contempt and misappropriation, reinforcing the idea that personal gains chosen at the expense of ethical behavior can lead to significant legal penalties.

The greater impact of this case extends beyond individual accountability; it highlights the importance of maintaining robust internal controls and ethical guidelines within organizations. Companies must invest in frameworks that not only prevent misconduct but also promote a culture of integrity and transparency. By doing so, they safeguard against potential abuses of power and strengthen their operational foundations against future challenges.

Asset Freezing Orders: Their Role and Relevance in Corporate Disputes

Asset freezing orders are crucial legal tools used by courts to prevent the dissipation of assets while disputes are being resolved. In the case of Karel Mañasco, these orders were put in place to protect the financial interests of the Mansion Group against alleged misappropriation. The ruling by the Gibraltar Supreme Court reveals the importance of these measures in upholding the integrity of the legal process. When parties in litigation resort to unauthorized transfers of funds, as seen in Mañasco’s case, it raises significant concerns about fairness and justice in corporate governance.

The unauthorized transfer of over £400,000 by Mañasco exemplifies why asset freezing orders are essential. They act as a safeguard for claimants, ensuring that defendants cannot manipulate their finances in ways that could compromise the outcomes of legal proceedings. This case reinforces the necessity for courts to actively enforce such measures, as doing so protects both the claimants and the judicial system’s reputation by mitigating potential injustices.

Moreover, the effectiveness of asset freezing orders is contingent on the willingness of the parties involved to comply with their legal obligations. Mañasco’s blatant disregard for the asset-freezing order underscores a robust challenge for the judiciary—how to ensure compliance and address violations effectively. The court’s intervention, leading to a contempt ruling and custodial sentence, serves as both a punishment for Mañasco and a warning to others in similar positions. As corporate disputes continue to arise in complex legal environments, the critical role of asset freezing orders cannot be overstated.

The implications of ignoring such orders extend beyond individual accountability; they threaten the broader justice system’s credibility. Courts must be able to rely on compliance from corporate leaders; when this trust is broken, it not only affects the current case but also has the potential to deter individuals from seeking justice in the future. Thus, asset freezing orders not only serve to preserve assets but also uphold the foundational principles of corporate governance and legal integrity.

The Role of Corporate Governance in Preventing Misconduct

Effective corporate governance is paramount in preventing misconduct, particularly in high-risk environments where executives have significant decision-making power. Karel Mañasco’s case serves as a prime example of how a lack of stringent governance structures can lead to allegations of misappropriation and breaches of fiduciary duties. The Mansion Group’s claims that Mañasco awarded himself excessive bonuses while engaging in dubious financial practices highlight the potential pitfalls when checks and balances are inadequate. Strong corporate governance frameworks are designed to ensure that executives operate within legal and ethical boundaries, fostering accountability and transparency.

Establishing robust oversight mechanisms is essential for any organization to minimize risks associated with executive misconduct. The implementation of regular audits, compliance training, and ethical guidelines helps mitigate the dangers of power concentration. Mañasco’s situation reflects a critical lapse in governance that allowed significant mismanagement to occur, demonstrating the necessity for proactive measures that ensure adherence to fiduciary duties and legal requirements.

In addition to promoting ethical behavior, effective corporate governance ensures that organizations can respond swiftly to allegations of misconduct. Robust governance frameworks not only help in early detection of inappropriate practices but also equip organizations with tools to address issues promptly before they escalate to legal disputes. Following the events that led to Mañasco’s sentencing, it is clear that companies must reinforce their commitment to ethical leadership and accountability, as the consequences of neglect can be devastating both legally and reputationally.

Moreover, a strong governance framework contributes to the overall health of the corporate culture, which in turn attracts and retains stakeholders who value integrity and reliability. Mañasco’s case should serve as a wake-up call for organizations to reassess their governance policies and practices. By prioritizing transparency and ethical conduct, companies can build a solid foundation that not only protects them from legal challenges but also enhances their image and operational success in the market.

Frequently Asked Questions

What were the charges against Karel Mañasco related to the Mansion Group?

Karel Mañasco, the former chief executive of Mansion Group, was found guilty of contempt of court after breaching asset-freezing orders and submitting false statements under oath. The Supreme Court of Gibraltar sentenced him to 12 months in prison for these violations.

How did Karel Mañasco violate fiduciary duties at Mansion Group?

Karel Mañasco is accused of violating his fiduciary duties by awarding himself excessive salaries and bonuses, making unauthorized transfers of over £400,000 to his wife’s account, and purchasing luxury items with corporate funds from Mansion Group.

What is the significance of the Gibraltar Supreme Court’s ruling on Karel Mañasco?

The Gibraltar Supreme Court’s ruling on Karel Mañasco is significant as it highlights severe violations of court orders and the erosion of trust in the administration of justice. The Chief Justice described Mañasco’s actions, including the egregious transfer of funds, as harmful to both the claimants and the rule of law.

What are the potential consequences for Karel Mañasco after the court ruling?

Following the court ruling, Karel Mañasco faces a 12-month prison sentence for contempt, with a possible six-month reduction if he repays the transferred funds. Additionally, he has a concurrent three-month sentence for submitting a false witness statement.

Can Karel Mañasco appeal the Supreme Court’s decision?

Yes, Karel Mañasco has the right to appeal the Supreme Court’s decision within 14 days without needing the court’s permission, which allows him to challenge the contempt ruling and other accusations against him.

What was the court’s reaction to Karel Mañasco’s transfer of £400,000?

The court reacted strongly to Karel Mañasco’s transfer of £400,000 to his wife’s account, labeling it as “egregious” and harmful, further indicating that such actions warranted a custodial sentence to uphold the rule of law.

What history of court attendance does Karel Mañasco have related to this case?

Karel Mañasco has a troubling history of failing to attend multiple court hearings, including the final sentencing session, which led to the issuance of a bench warrant for his arrest.

How do the allegations against Karel Mañasco relate to his tenure at Mansion Group?

The allegations against Karel Mañasco during his tenure at Mansion Group include misappropriating approximately £5 million, breaching fiduciary duties, and failing to act in the best interest of the company, which form the basis of the civil dispute and court decisions.

| Key Point | Details |

|---|---|

| Karel Mañasco’s Sentence | 12 months in prison for contempt of court. |

| Reason for Sentence | Breaching asset-freezing orders and submitting false statements. |

| Unauthorized Fund Transfer | Over £400,000 transferred to his wife’s account in Spain. |

| False Witness Statement | Understated expenditures by nearly £77,000. |

| Judicial Remarks | Violations deemed severe by Chief Justice Anthony Dudley. |

| Custodial Terms | 12 months sentence, with potential 6-month reduction upon repayment. |

| Concurrent Sentence | 3 months for the false statement to be served concurrently. |

| Underlying Civil Dispute | Allegations of misappropriating about £5 million from Mansion Group. |

| Allegations Denied | Mañasco denies all allegations against him. |

| Failure to Attend Hearings | Failed to attend several court hearings; bench warrant issued. |

| Right to Appeal | Mañasco retains the right to appeal within 14 days. |

Summary

Karel Mañasco’s case highlights serious legal ramifications when one violates court orders and provides false information under oath. His sentencing showcases the judicial system’s commitment to upholding the rule of law, especially in cases of significant financial misconduct. With a history of alleged fiduciary breaches and substantial anti-justice actions, the implications of Mañasco’s actions extend beyond personal consequences to affecting broader legal standards. As he is now faced with not only imprisonment but also the possibility of further legal proceedings, it serves as a critical reminder for individuals in positions of trust and responsibility.